價格:免費

更新日期:2020-03-04

檔案大小:18.5 MB

目前版本:2.1.9

版本需求:系統需求:iOS 10.0 或以後版本。相容裝置:iPhone、iPad、iPod touch。

支援語言:英語

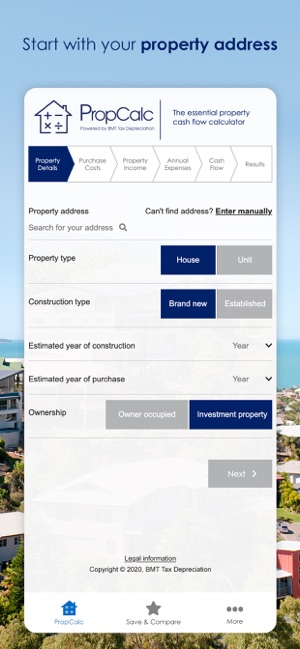

PropCalc, is the essential property cash flow calculator and is the tool you need when doing property research. Taking the first step towards home ownership or property investment involves research. You’ll need to assess your finances, determine how much you can afford to repay and calculate your holding costs. PropCalc is the essential property cash flow calculator showing you the real cost of owning a property and exactly how the purchase will affect your cash flow.

More than just a mortgage calculator, PropCalc:

- Uses customised data to determine the after-tax holding cost of any property

- Accounts for a range of expenses such as interest, stamp duty, deposit amount, insurance, council and

property management rates, body corporate fees, repairs and maintenance costs

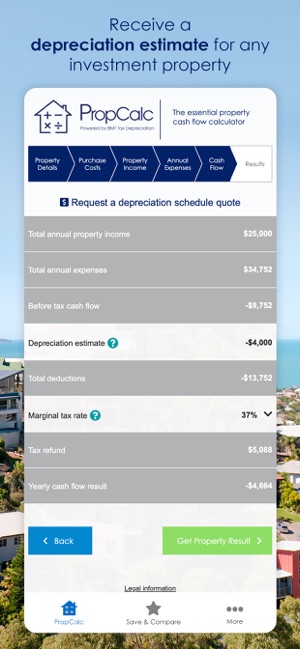

- Factors in potential rental income, number of weeks rented, annual income and any depreciation claims

available from income producing properties

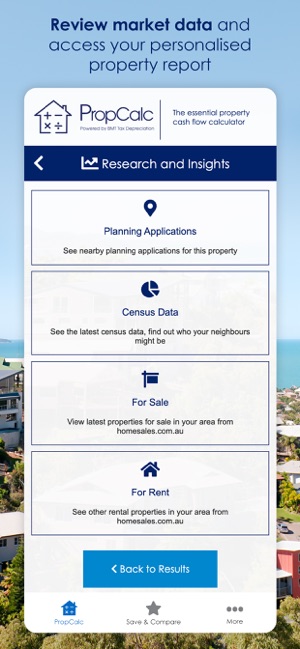

PropCalc is free to use, however for the best experience, to save and compare properties and access reports, you’ll need to register via MyBMT, a free, online portal to help you manage depreciation and investment property needs. Find out more about MyBMT and register within the app today or visit https://mybmt.bmtqs.com.au.

Learn more about BMT Tax Depreciation

BMT Tax Depreciation specialise in maximising depreciation deductions for property investors Australia-wide. The Australian Taxation Office allows investment property owners to claim a deduction related to the building and the 'plant and equipment' assets contained within it. Depreciation can be claimed by any owner of an income producing property. This deduction essentially reduces taxable income for investors – they pay less tax.

Every investment property should have a tax depreciation schedule completed to unlock its full cash flow potential. Property owners could be saving thousands of dollars every year. To learn more about property depreciation or to request a quote visit our website at bmtqs.com.au.

支援平台:iPhone, iPad